Posts

Continental Pushes Autonomous Boundaries

/0 Comments/in Article, Industry, Technology, Technology CompanyBurney Simpson

Tier 1 auto technology firm Continental Corp. this month moved quietly but confidently to strengthen its leading position in the global development of autonomous driving.

Continental participated in the recent driverless demo in Virginia that received international press coverage, driving its own Chrysler 300c right behind the Cadillac SRX that Virginia Tech Transportation Institute researchers took for a spin near Washington, D.C. (See “Virginia Seeks Autonomous Research Lead,” October 20).

The black Chrysler’s autonomous technology included five radars and six cameras, along with Redundant Sensing and Actuation Architecture that doubles brake, steering, power and communication lines so the car can continue driving safely if there is any failure of the primary controls.

The camera system operates a forward-facing stereo camera, a surround view camera system that includes four 185-degree field of view fish-eye cameras, and a Driver Analyzer camera focusing on the driver.

Ibro Muharemovic, Continental’s head of advanced engineering NAFTA, noted that Continental had already tested an early-driverless vehicle for about 55,000 miles on U.S. roads in 2012. This precedes the highly publicized cross-country drive that Continental rival tier 1 supplier Delphi took this spring.

Continental is currently testing its autonomous vehicles in a number of states, and “when other states make their roads available, we will go there,’ said Muharemovic.

Also this month, Hanover, Germany-based Continental launched its Holistic Connectivity demo vehicle at the ITS World Congress in Bordeuax, France. Drivers can use the Human-Machine Interface in the car’s console to obtain by voice or visual interaction the vehicle diagnostic data along with traffic information. Drivers can also make commands to their home systems, allowing for the control of temperature and lighting.

In addition, Continental announced that Augmented Reality (AR) Creator software developr Elektrobit Automotive would operate as a standalone company. Continental purchased Elektrobit in July. AR Creator offers visualized lane positioning, navigation data, environmental modeling, and other autonomous-related capabilities.

GM Takes D20 Over 160

/0 Comments/in ArticleDriverless Transportation

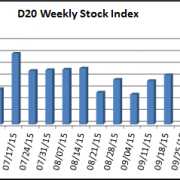

The Driverless Transportation (D20) Stock Index broke the 160 barrier for the first time ever, finishing at 160.77 last week. For the fourth consecutive week, the D20’s 2.9 percent gain outpaced the 2.5 percent gain in the Dow Jones Industrials and the 2.1 percent rise in the S&P 500 Index. The D20 saw 17 stocks finishing higher while three declined.

This week’s largest loser was Tesla (TSLA) down 7.9 percent on news that Consumer Reports held back its rating on the Model S owing to reliability concerns. Tesla finished the week at $209.09, its lowest point since mid-April 2015. On the driverless front, Tesla announced the release of its Autopilot update for the Model S. The reviews of the software update for existing cars are mostly positive, but some users have complained that the Model S takes turns too fast in Autopilot mode.

On the bright side, General Motors (GM) posted its fourth consecutive weekly gain by adding 8.5 percent and ending the week at $35.95 a share. Most of the jump was due to GM’s surprisingly positive third-quarter earnings announcement. GM has adopted a quiet but aggressive plan to develop “self-driving” cars.

On the bright side, General Motors (GM) posted its fourth consecutive weekly gain by adding 8.5 percent and ending the week at $35.95 a share. Most of the jump was due to GM’s surprisingly positive third-quarter earnings announcement. GM has adopted a quiet but aggressive plan to develop “self-driving” cars.

Other D20 stocks that put in strong showings last week were Alphabet (GOOG) up 6.0 percent, Continental (CTTAY) up 6.9 percent, Magna (MGA) up 6.0 percent, and Valeo (VLEEY) up 6.2 percent.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks

IBM Raises Profile on IoT and Connected Cars

/0 Comments/in Article, Industry, Technology, Technology CompanyBig Blue is hitting the accelerator on connected car technology.

IBM is sending its executives to appear at conferences a month after releasing a cloud-based service for automakers that is designed to use the Internet of Things (IoT) so cars can communicate with their owners.

IBM’s IoT for Automotive product will gather data from sensors installed in the vehicle, analyze the information, and let the owner know she needs to change the oil, or communicate with a third-party like a garage or a parking lot, IBM announced.

IBM has been working for several years on connected-vehicle communications systems with German-based auto-technology provider Continental.

Next month, IBM will be presenting at the Connected Fleets USA Conference in Atlanta, discussing the Smart City and its impact on fleets.

Calvin Lawrence, CTO of analytic solutions at IBM, will discuss Smarter Cities for Smarter Infrastructure. In a press release Lawrence says, “(A)s citizens themselves continue to be more socially capable and mobile - their expectation is that the cities in which they live will be fit for purpose. This is especially true for the fleet industry which relies on the efficiency of cities to keep logistics running.”

The connected fleets confab is put on by TU-Automotive and runs Nov. 16-17 in the Grand Hyatt.

Connected Fleet Experts to Converge on Atlanta

/0 Comments/in Article, Future, Impact, Industry, TechnologyThe rise of connected technology for fleets is the theme of this year’s TU-Automotive Connected Fleets USA//The Future of Fleets conference November 16-17, at the Grand Hyatt in Atlanta.

There will be speakers from such trucking industry firms as Navistar, Hertz, Continental, Peloton, Donlen, Ricardo, and Cummins.

The conference will attract over 300 attendees with many having the authority to make purchasing decisions. At the 2014 Connected Fleets, more than 75 percent were presidents, managers or directors, while another 9 percent were at the C-level at their firms.

Categorized by firm, 21 percent of attendees last year were with transportation service providers, 17 percent fleet service/operators, 16 percent Tier 1 suppliers, 13 percent OEMs, and 10 percent were hardware manufacturers.

This year’s seminars will focus on topics that the industry is talking about as it moves to the connected world.

Data will be the focus of two important seminars, one on techniques for turning data into revenue, and the second on the promise of a single data standard for fleets.

Cybersecurity is rising to the fore for fleets as they collect all this data. In general, connectivity is proving to be a strong positive for fleets but the issue becomes ensuring how to protect yourself from hackers.

Another major issue every year is staff, especially drivers. Driver-facing cameras has seen some pushback, so Leaseplan will address this conflict in a presentation with ideas on getting driver buy-in for the technology. There will also be a seminar on driver training that improves safety and lowers accidents.

And there will be some forward looking seminars that look at the next steps in fleet connectivity. One panel will consider whether the Uber model can be transferred to the trucking industry, while another will look at drones and their ability to monitor weather and road conditions, and track trucks.

To review the list of seminars and speakers click here.

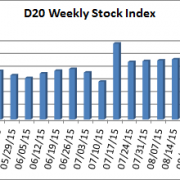

Growing Driverless Stock Index (D20) Reflects Dynamic Industry

/1 Comment/in Article, Impact, Industry, Technology Company, Vehicle CompanyWe have some exciting changes in the Driverless Transportation D20 Index to announce. First off, we are replacing three companies in the index and making the D20 more international in scope. We also changed the basis for our calculation of the D20 Index, moving to a dollar averaged approach.

The three new stocks in the D20 are:

- Amsterdam-based TomTom (TOM2) is traded on the Amsterdam Stock Exchange. It replaces Nokia (NOK) which is selling its Here mapping division, its only business involved in driverless or connected vehicles. TomTom, known for its popular aftermarket GPS turn-by-turn directional devices for cars, has three units that are involved with driverless technology – the auto unit provides components such as maps, traffic and software to auto OEMs; the licensing group leverages maps, traffic and navigation content and services; and the telematics unit is dedicated to fleet management and vehicle telematics.

- Ontario, Canada-based Magna International (MGA) is traded on the NYSE. It replaces the lightly-traded KVH Inc. (KVHI), a business that primarily delivers ISP services for hotels, resorts and ships. Magna has a large and growing electronics division which focuses on driver assistance systems, as well as systems to support power-train electrification. It manufactures electronic, electromechanical and mechatronic products, and provides software and hardware development.

- Tokyo-based Renesas Electronics (TYO: 6723) trades on the Tokyo Stock Exchange. It replaces Iteris (ITI), a lightly-traded firm that provides intelligent transportation systems for municipalities. Renesas was formed through a merger of NEC Electronics Corp., and Renesas Technology Corp., (a joint venture of Hitachi and Mitsubishi Electric). Renesas Electronics is a semiconductor manufacturer that designs, develops, manufactures, sells and services microcontrollers for the automotive industry.

The D20 Index now has companies — TomTom in Amsterdam and Renesas in Tokyo — with stocks that are primarily listed on non-US exchanges and use foreign currencies for prices. To calculate the D20 and include these stocks we convert the non-US stock prices (Euros and Japanese Yen) to US dollars using a current conversion ratio. The values were: Euro – currently 1.136 dollars per Euro; and Japanese Yen – currently .00829 dollars per Yen.

CALCULATING THE INDEX

We have changed the basis for calculating the D20 Index. Previously, the value of the D20 was calculated by using one share of stock from each of the 20 stocks in the index. With the new dollar-averaged approach we track the value of $1,000 invested in each of the 20 stocks. And on August 28, 2015 we started with roughly a total of $20,000 invested equally in the 20 stocks ($1,000 per company) in the D20 Index.

|

Name |

Symbol |

(As of 8/28/2015) | |||

| Share Price | Shares | Currency Conversion | Value | ||

| BlackBerry Ltd | BBRY | $ 7.37 | 135.690 | 1.000 | $ 1,000 |

| BYD COMPANY LTD ADR | BYDDY | $ 8.44 | 118.480 | 1.000 | $ 1,000 |

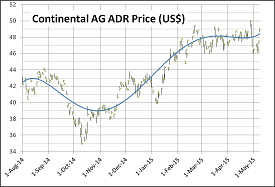

| Continental AG (ADR) | CTTAY | $ 42.86 | 23.330 | 1.000 | $ 1,000 |

| Daimler AG (USA) | DDAIF | $ 80.70 | 12.390 | 1.000 | $ 1,000 |

| Delphi Automotive PLC | DLPH | $ 75.35 | 13.270 | 1.000 | $ 1,000 |

| Denso Corp (ADR) | DNZOY | $ 22.69 | 44.070 | 1.000 | $ 1,000 |

| Ford Motor Company | F | $ 13.73 | 72.830 | 1.000 | $ 1,000 |

| General Motors Company | GM | $ 29.01 | 34.470 | 1.000 | $ 1,000 |

| Google Inc | GOOG | $ 630.38 | 1.586 | 1.000 | $ 1,000 |

| Magna | MGA | $ 49.23 | 20.313 | 1.000 | $ 1,000 |

| Mobileye NV Amsterdam | MBLY | $ 56.42 | 17.724 | 1.000 | $ 1,000 |

| Nissan Motor Co., Ltd. (ADR) | NSANY | $ 18.31 | 54.620 | 1.000 | $ 1,000 |

| NVIDIA Corporation | NVDA | $ 22.73 | 43.990 | 1.000 | $ 1,000 |

| Tesla Motors Inc | TSLA | $ 248.48 | 4.025 | 1.000 | $ 1,000 |

| TomTom | TOM2 | € 8.97 | 100.010 | 1.115 | $ 1,000 |

| Visteon Corp | VC | $ 100.49 | 9.950 | 1.000 | $ 1,000 |

| VALEO SA (ADR) | VLEEF | $ 63.66 | 15.710 | 1.000 | $ 1,000 |

| Volkswagen AG (ADR) | VLKPY | $ 38.32 | 26.100 | 1.000 | $ 1,000 |

| Volvo AB (ADR) | VOLVY | $ 10.94 | 91.410 | 1.000 | $ 1,000 |

| Renesas | TYO:6732 | ¥ 708.00 | 168.008 | 0.00841 | $ 1,000 |

Why the change? We found that with the one-share approach the stocks with the highest prices, i.e., Google, trading over $600, and Tesla, over $250, could swing the D20 wildly with just a small change in their pricing. The dollar-average approach means each company in the D20 now makes up about five percent of the index’s underlying value.

Why didn’t the D20 Index change radically when we switched the basis? We have always used a divisor with the D20 Index, and it started as 10.0. That meant we added up all the stock prices at the close of the trading day and divided by 10. To switch to the new dollar-average approach we changed the divisor so the new D2’s underlying value would be the same as the old D2. So on August 28, 2015 we used the closing stock prices to find the value of each of the two D20s, then adjusted the divisor for the dollar-averaged D20 so it had the same value as the old D20. The new divisor is 134.27296.

On September 4 we switched over to the revised D20 Index with the three new stocks and the new divisor.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

Industry Preps for Automated Vehicles Symposium 2015

/0 Comments/in Article, Future, Government, Industry, Insurance, Technology, UniversityDriverless Transportation

The Automated Vehicles Symposium 2015 is coming on fast, and will be held July 21-23 in Ann Arbor, Mich., sponsored by Automation for Unmanned Vehicle Systems International (AUVSI) and the Transportation Research Board (TRB), and held at the University of Michigan. There are also ancillary meetings scheduled for July 20, and July 24.

The AVS15 describes itself as “a multidisciplinary forum designed to advance the deployment of automated vehicles.” The keynote address on Wednesday, July 22 will be given by Chris Urmson, leader of Google’s self-driving cars efforts.

The AVS15 will also offer a number of break-out sessions that are closed to the media.

AVS15 benefactors are AutonomouStuff, Bosch, Continental, Denso, KVH, Magna, Munich Re, Realtime Technologies, Tass International, and Velodyne.

Learn more about the Symposium.

POSTER SESSIONS

AVS15 will offer two poster sessions, giving exhibitors the opportunity to showcase and discuss their work with colleagues. Abstracts for both sessions are due by June 7, and peer review decisions will be announced by June 21.

The first poster session will be held on Tuesday, July 21. It is designed for peer-reviewed research posters, with a presentation of a completed project that takes a similar approach to an academic journal or a Transportation Review Board poster session.

The second session will run on Wednesday, July 22, and cover a broader range of content, from introductions to research centers, to works in progress, to proposed studies.

The AVS15 website provides further guidelines and submission requirements for each poster session.

Continental AG Leads D20 Index Rebound

/0 Comments/in Article, Economics, Industry, TechnologyDriverless Transportation

The Driverless Transportation (D20) Stock Index regained most of last week’s loss by adding 2.06 points, or 1.4 percent, to finish the week at 146.874. Twelve D20 Index stocks gained ground while seven lost value and one remained unchanged.

Adding to its three-week consecutive gain streak, Tesla Motors (TSLA) led the way with a $10.58 or 4.7 percent gain to end the week at $236.61. The percentage and absolute loser, NVIDIA (NVDA) fell sharply, losing $1.93, or 8.5 percent of its value, to close Friday at $20.82. The Santa Clara, Calif.-based tech house said it would announce lower earnings for its second quarter. Google (GOOG) was remarkably quiet this week gaining a tiny $0.32 or 0.1 percent.

The D20 Index began on August 1, 2014 valued at 139.694, and was launched publicly October 7. It includes OEMs, parts suppliers, technology companies, and technology OEMs, from around the world.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

DHL Report on Self-Driving Vehicles

/0 Comments/in Article, Future, Impact, Industry, Insurance, Legal, Technology, TransportationLast week, international logistics company DHL released a report entitled “Self-Driving Vehicles in Logistics.” The report provides a comprehensive overview of the current state of the driverless transportation industry. It gives a good, high-level overview of the current state of the technology and its legal issues, as well as perceived consumer acceptance. (We here at Driverless Transportation aren’t sure there is much value in consumer surveys at this point.) It then gives a good rundown, by manufacturer, on the current state of the art in autonomous capabilities.

The core of the report, of course, was the implications of driverless technology on logistics. Here it goes through the logistics process from the initial warehouse through delivery to the end customer. They do make a compelling case about how driverless technology is more likely to impact logistics than passenger vehicles in the short term.

Click here for the full report. It is worth checking out.