Posts

Record High for D20 Index

/0 Comments/in Article, Industry, Transportation, Vehicle CompanyDriverless Transportation

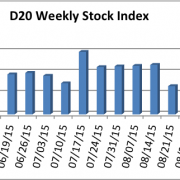

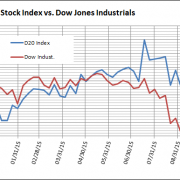

With 19 gainers and only one loser, the Driverless Transportation Index (D20) displayed impressive strength last week by jumping 4.4 percent to an all time high of 161.34. The D20 outperformed the Dow which gained 3.4 percent to close the week at 17823.81 and the S&P 500 which, in its best week of 2015, added 3.3 percent to finish at 2089.17.

The lone smudge on an almost perfect week was Volvo AB (VOLVY), the Swedish truck manufacturer, as it announced it was idling its US plant for two-and-a-half weeks in December due to excessive inventory and softening demand. Volvo’s ADR stock price lost 1.1 percent of its market capitalization and ended the week at $10.18

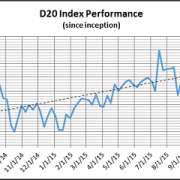

The D20 has breached the 160 mark three separate times in the last five weeks and has added 14 percent to its value in the last eight weeks. Since its inception at 139.7 on August 1, 2014, the D20 has ranged from 130.01 (down 6.9 percent) on October 17, 2014 to last Friday’s close of 161.34 (up 15.5 percent). Linear regression (displayed as the dotted black line in the graphic here) places the D20’s growth at 13.4 points per year, or 9.6 percent.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

California DMV Hopes to Release Self-Driving Car Regulations by Year’s End

/0 Comments/in Industry, Legal, News, Technology, TransportationSacramento Business Journal

Google’s Battle With the California DMV Drags On

/0 Comments/in Future, Impact, Industry, Legal, News, TechnologyNews & Observer

TomTom is D20’s Lone Star

/0 Comments/in Article, Impact, Industry, Technology, Technology Company, Vehicle CompanyDriverless Transportation

Last week, the Driverless Transportation Index (D20) followed the S&P 500 and the Dow Jones Industrials down dramatically as all three indexes lost more than 3 percent of their value. The D20 Index lost 3.9 percent, finishing the week at 154.59 while the Dow dropped 3.7 percent and the S&P 500 discarded 3.6 percent of its value.

Trading in the D20 last week was almost unanimous with 19 losers and a sole gainer, TomTom (TOM2), the high-tech mapmaker. TomTom jumped €0.82, or 8 percent, to finish at €11.03. TomTom’s stock price hit a six-year high as Uber agreed to use its digital maps and traffic data for more than 300 cities around the world. As the last independent supplier of detailed mapping information, rumors continue to swirl around TomTom as an acquisition target. Since its inclusion in the D20 on August 28, TomTom’s stock price is up 23 percent.

The rest of the D20 was not as promising as a trio of D20 stocks lost more than 10 percent of their value. Blackberry (BBRY) gave up gains recorded the previous week, losing 10.1 percent to finish the week at $7.21. Tesla (TSLA), a top gainer the previous week, gave up that success and finished at $207.19, down 10.8 percent. Magna International (MGA) fell 10.1 percent to $43.40 for its third consecutive weekly loss.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

Driverless Index Crawls Over 160

/0 Comments/in Article, Industry, Technology, Technology Company, Vehicle CompanyDriverless Transportation

The Driverless Transportation (D20) Stock Index crawled above 160 for the second time in its history, ending the week up 1.1 percent at 160.83. Gainers outpaced losers 13 to seven as the D20 couldn’t keep up with the 1.4 percent rise in the Dow Jones Industrials which ended the week at 17910.33. The D20 slightly outperformed the S&P 500 and its rise of nearly 1 percent to finish at 2099.2.

Tesla (TSLA) was the D20 leader, increasing its stock price 12.3 percent to close the week at $232.36. Tesla has been having trouble meeting the demand for its Model S but its stock soared after its third quarter report revealed that it broke quarterly production records. NVIDIA (NVDA) was a D20 bright spot as well. It finished up 11.2 percent at $31.55 as it announced surprisingly good third quarter results.

Volkswagen’s (VLKPY) steep descent continued, dropping 12.6 percent to finish the week at $21.09 as its emissions scandal continues to deepen. Models from Audi and Porsche, both subsidiaries of Volkswagen, have now been implicated as well. It has lost 45 percent of its market cap since mid September.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

California DMV finalizing self-driving regulations, says it supports Tesla Autopilot as legal Level 2 tech

/0 Comments/in Impact, Industry, Legal, News, TechnologyHybridCars.com

Google, Tesla and Other Automakers Still Waiting for DMV Self-Driving Rules

/0 Comments/in Consumer, Future, Impact, Industry, Legal, News, TechnologySan Jose Mercury News

California DMV Will Now Include Reports of All Autonomous Vehicle Accidents On Its Website

/1 Comment/in Article, Industry, Legal, TechnologyJennifer van der Kleut

It has been said over and over again that autonomous vehicles will reduce the number of traffic accidents each year by as much as 80 to 90 percent, depending on who you ask.

Therefore, it is not surprising that when one of the foremost companies working on driverless car production, Google, has more than 10 accidents involving their driverless test cars in the past year, people are going to want to know what happened.

Earlier this year, when Google’s koala cars got into a few fender-benders - including the first to involve minor injuries to the passengers - the news media flew into an uproar. Reporters and news outlets demanded that California’s Department of Motor Vehicles (DMV) should disclose details of the accidents, if for no other reason than the public has a right to know if Google’s test cars are going to share the road with human-driven cars in the Bay Area.

The DMV appears to have heard the call, loud and clear. The department recently created a dedicated page on its website linking to reports of accidents involving autonomous cars.

Nine reports are up on the site this week, spanning October 2014 to August 2015. Of those, eight are linked to a Google car and one is linked to Delphi Automotive. All personal information such as insurance companies and names of passengers are redacted, but details of the accidents and company names are visible.

The report of the Delphi accident, which occurred in October last year, involved one of its Audi test vehicles traveling in the Mountain View/Los Altos area of California’s Bay Area.

The report indicates the test car was waiting for traffic to clear so that it could merge onto a multi-lane road when a Honda attempted a dangerous turn and accidentally came up over the center median, crashing into the Audi test car.

The reports indicate the Audi’s right front bumper was damaged. The driver of the Honda was found to be at fault and given a citation “for making an unsafe turning movement.”

ACCIDENT WITH INJURY

In the only reported autonomous car accident thus far to involve any injuries, a Google Lexus AV was involved in a minor accident with a Tesla Model S on Aug. 20 when it slowed to yield to a pedestrian, the DMV’s report indicates.

The Google test car was traveling down Shoreline Boulevard in Mountain View when it slowed. Meanwhile, the Tesla was changing lanes into the one the Google car was in, and the Tesla rear-ended the Google car at approximately 10 miles per hour, according to the report.

One of the Google employees in the car felt back pain and was taken to the hospital, where he was evaluated and released. The Google car sustained minor damage to its rear bumper. The Tesla car sustained more serious damage and was towed from the scene.

As these reports indicate, one problem that occurs when autonomous cars share the same roads with human-driven cars is that the autonomous car operates almost too safely. Human drivers - even at 10 miles per hour - can be more aggressive and do not anticipate the autonomous car to be so “by-the-book.” Further, it’s probably a safe bet that few human drivers know that current Google test cars have a maximum speed of 25 miles per hour, regardless of whether they’re traveling on a road with a higher speed limit.

Visit the California DMV’s page for autonomous vehicle accident reports.

Volkswagen Drives D20 Down

/0 Comments/in Article, Industry, Vehicle CompanyDriverless Transportation

Driven by Volkswagen’s huge loss the Driverless Transportation (D20) Stock Index tumbled 5.8 percent and ended last week at 142.05. The loss was broad based as D20 losers outnumbered gainers 18 to two. On news that the global economy is slowing, both the Dow Jones Industrial Average and the S&P 500 lost value last week although less than the D20 Index. The Dow ended the week at 1631.67, down 0.4 percent while the S&P 500 finished at 1931.34, down 1.4 percent.

A 34.3 percent drop in Volkswagen’s stock price was responsible for over a quarter of the D20 loss for the week. Volkswagen’s ADR (VLKPY) price hit a 52-week low of $21.87 on Monday, less than half its D20 Index high of $54.02 it hit just over six months last March. The automaker’s woes continue to be driven by the diesel pollution testing scandal. Its CEO has resigned and shareholder lawsuits have arisen. Volkswagen’s current financial crisis will curtail its ability to invest in driverless technologies as it tries to weather the government fines, shareholder lawsuits, and negative market impact of this scandal.

The lone Chinese company in the D20 Index, BYD Company (BYDDY), shone brightly this week rising almost 6 percent and finishing at $9.91. At 6.16 percent, it is now is the largest component of the D20 Index. BYD has added 17.4 percent to its ADR price since August 28 when the basis for the D20 Index was changed.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.