Darcy Conlin

Yeganeh Mashayekh Hayeri, Ph.D.

This featured article takes a look at some of the work going on in Pennsylvania in conjunction with University of Pennsylvania (UPenn) and the Pennsylvania Department of Transportation (PennDOT). Yeganeh Mashayekh Hayeri is a post-doctorate research fellow at UPenn who works with the GRASP lab (General Robotics, Automation, Sensing & Perception). She was a researcher at Carnegie Mellon University (CMU) with USDOT T-SET UTC (Technologies for Safe and Efficient Transportation). Hayeri’s projects are funded by UTC.

We frequently hear about what is happening within the driverless industry in states like California and Nevada. Hayeri has experience working in both of these states but now finds herself in Pennsylvania.

The juxtaposition between geography is just one of the challenges that needs to be sorted out within this industry. Hayeri is working to help educate people about the overall impact that the evolving autonomous industry will have on our transportation system. This emerging technology is creating a paradigm shift in the way we think about issues relating to transportation regardless of what coast you live on, or whether you are north or south of the Mason-Dixon line.

There is a lot going on in Pennsylvania. Let’s start by acknowledging that last November, CMU celebrated the 30th birthday of self-driving car technology and has touted itself as the birthplace of self-driving cars. That’s right – Pennsylvania, not Mountain View, Calif.

Also, the GRASP lab where Hayeri finds herself these days is a vital and cooperative environment fostering interaction between students, research staff and faculty. GRASP is a $10-million research center founded in 1979 and, according to Hayeri, is exactly what you would think from the acronym. There are all kinds of things happening in robotics, automation and perception — all necessary concepts for research related to automated transportation systems.

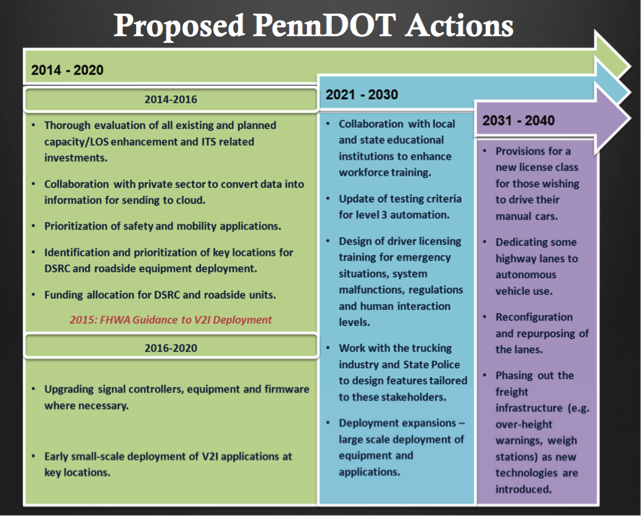

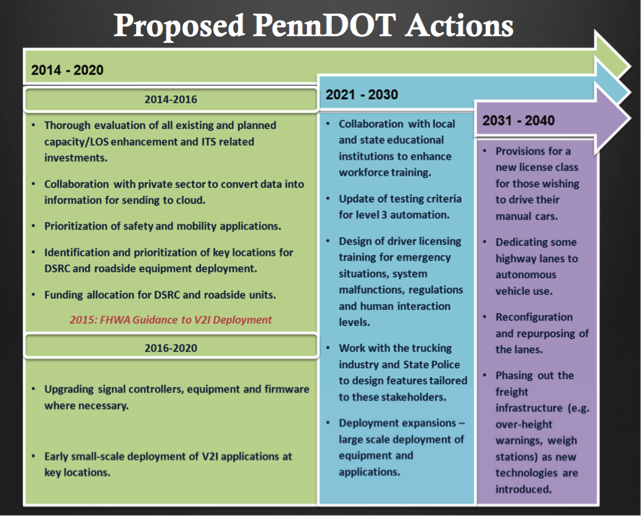

One of the recent projects Hayeri worked on was the “Connected and Autonomous Vehicles - 2040 Vision” project with PennDOT. This one-year visionary project examined the impact that these new technologies would have on the state’s investment decisions, infrastructure, workforce training, driver licensing, and communications systems. Concluding this past July, the project took a high-level qualitative analysis of various impacts from these technologies.

With the focus on Pittsburgh, one of the short-term action items was to allocate funding for and identify key locations for dedicated short-range communication (DSRC) and roadside equipment deployment. Between 2016 and 2020 the project proposes early, small-scale deployment of vehicle to infrastructure (V2I) applications at these key locations. The longer-term plans include working with local and state educational institutions to enhance workforce training, along with tailoring certain features to the trucking industry. This gra phic spells out the proposed actions arising from the project.

phic spells out the proposed actions arising from the project.

Fundamentally, all DOTs want to create a sustainable transportation system that will prepare them for the future. By working with PennDOT, Hayeri hopes to bridge the gap between collaborating with local communities and educating both state planners and locals on individual needs and concerns.

Her latest project, while still within the automated transportation world, has a bit of a twist to it.

With the help of UPenn’s Department of Electrical and Systems Engineering, Hayeri and her colleagues are modeling human behavior while driving using inverse reinforcement learning techniques. In simple terms, reinforcement learning looks at the behavior of an agent (the driver), his utility and reward functions, and his actions in an environment.

Hayeri chose traffic engineering as a career because she is fascinated by human psychology and its impact on traffic operations and planning, something she believes has been missing from much of the previous models and theories. While staying present behind the wheel has always been crucial, driver distraction today has reached saturation.

With inverse reinforcement learning techniques the hope is to evaluate enforced policies, like speed limit rules, and their effectiveness. What type of a reward function drivers use to make driving decisions is the key element to Hayeri’s current research. Her goal is to understand how people set up these reward functions internally and how they react.

According to Hayeri, “The goal is to gauge the effectiveness of a policy or a combination of policies by modeling humans’ behavior and examining the patterns. This research should assist decision and policy makers to set informed and effective policies as we enter the automated transportation era.”

There are many challenges ahead. One is the legislative policy toward autonomous transportation and driving that each state DOT, along with the US DOT, will need to work out. The new regulations and their enforcement, and the interaction between the states and the federal government in policing this technology, will all have to be determined. Then there is the challenge of states in different regions and how they will address difficult weather such as snow and fog.

Behaviorally there are questions about how drivers of automated vehicles will interact with automated features, and how drivers of conventional vehicles will interact with driverless vehicles.

Hayeri is passionate about contemplating ways to bridge the gap between our traditional way of thinking about transportation, and transitioning to the future with connected and autonomous vehicles. Looking at current human behavior and what people’s perceptions of autonomous vehicles are is a necessary task. The differences in individuals, what they are willing to accept and how quickly they can change their current patterns of behavior will all have an impact on how this will evolve.

In her own words, Hayeri thinks of herself as an “impact specialist,” and is wondering if, as a culture, we are ready to let go of our cars – a question she is not alone in contemplating. We look forward to seeing what else comes down the Pennsylvania Turnpike.