Posts

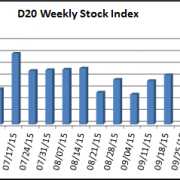

GM Takes D20 Over 160

/0 Comments/in ArticleDriverless Transportation

The Driverless Transportation (D20) Stock Index broke the 160 barrier for the first time ever, finishing at 160.77 last week. For the fourth consecutive week, the D20’s 2.9 percent gain outpaced the 2.5 percent gain in the Dow Jones Industrials and the 2.1 percent rise in the S&P 500 Index. The D20 saw 17 stocks finishing higher while three declined.

This week’s largest loser was Tesla (TSLA) down 7.9 percent on news that Consumer Reports held back its rating on the Model S owing to reliability concerns. Tesla finished the week at $209.09, its lowest point since mid-April 2015. On the driverless front, Tesla announced the release of its Autopilot update for the Model S. The reviews of the software update for existing cars are mostly positive, but some users have complained that the Model S takes turns too fast in Autopilot mode.

On the bright side, General Motors (GM) posted its fourth consecutive weekly gain by adding 8.5 percent and ending the week at $35.95 a share. Most of the jump was due to GM’s surprisingly positive third-quarter earnings announcement. GM has adopted a quiet but aggressive plan to develop “self-driving” cars.

On the bright side, General Motors (GM) posted its fourth consecutive weekly gain by adding 8.5 percent and ending the week at $35.95 a share. Most of the jump was due to GM’s surprisingly positive third-quarter earnings announcement. GM has adopted a quiet but aggressive plan to develop “self-driving” cars.

Other D20 stocks that put in strong showings last week were Alphabet (GOOG) up 6.0 percent, Continental (CTTAY) up 6.9 percent, Magna (MGA) up 6.0 percent, and Valeo (VLEEY) up 6.2 percent.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks

General Motors Declares Itself The Leader in Autonomous Tech

/0 Comments/in Consumer, Industry, News, TechnologyInsider Car News

Autonomous Tech Scales Capitol Hill

/0 Comments/in Article, Association, Future, Government, Industry, Technology, Technology Company, Transportation, UniversityBurney Simpson

The autonomous transportation industry brought its game to Capitol Hill this week, holding a nearly all-day event that featured speeches from a U.S. Senator, four Congressmen, and a number of driverless leaders, all over the course of a luncheon, a seminar, and a showcase event/cocktail party with several dozen of the top firms in the business.

Not bad for a day’s work.

Trade group ITS America put on ‘The Future of Mobility: Rethinking Transportation for the Next 30 Years’ and garnered the participation of Sen. Gary Peters, a Michigan Democrat, and Representatives Earl Blumenauer, an Oregon Democrat, Rodney Davis, an Illinois Republican, and Peter DeFazio, a Democrat from Oregon.

While much of the conversation was positive and friendly, a few of the seminar panelists took the opportunity to raise issues that Congress may have to address someday.

- Data Privacy and Security — Daniel Morgan, chief data officer with the US Department of Transportation, noted that the security and privacy of citizen travel data was essential but that the information could be beneficial for metropolitan planners. Morgan floated the idea that a third party firm be responsible for collecting and storing the data if people objected to the federal government holding it.

- Reserving DSRC wavelength for V2V and V2I — Alan Korn, an executive with heavy-truck parts supplier Meritor WABCO, said the Dedicated Short-Range Communications 5.9 GHz spectrum must be reserved for Vehicle-to-Vehicle and Vehicle-to-Infrastructure communications to ensure autonomous driving safety. Later, Sen. Peters said that new technology may allow for the sharing of the 5.9 spectrum with other Wi-Fi users.

- Driverless Timeline — Supplying a welcome dose of reality was Tom Dingus, director of the Virginia Tech Transportation Institute (VTTI). Dingus said developing a truly autonomous system would be considerably more difficult and probably take longer than some recent studies and press reports suggest. Driverless vehicles will have to be safer than the much-maligned human driver but consider that the average human has one rear-end crash every 25 years, and makes 3 million braking decision in that time, said Dingus. “It is very difficult to build a system that is that robust,” said Dingus.

The exhibition hall featured 22 organizations involved with autonomous transportation development, including Eberle Design, Econolite, GM, Iteris, the University of Michigan Mobility Transformation Center, NXP Semiconductors, Southwest Research Institute, and Uber.

VTTI was there too taking a bit of a victory lap after its successful demo this week on a nearby highway of its driverless Cadillac SRX. The ride along featured Sen. Mark Warner, a Virginia Democrat, and generated extensive media coverage (See “Virginia Seeks Autonomous Research Lead,” October 20, 2015).

The showcase garnered a little more exposure for the technology with another half-dozen members of Congress visiting the exhibit hall to check out the firms on display, according to an ITS spokesperson.

The day also offered an exhibit of a DeLorean car from an old movie that predicted people would fly on skateboardy-type things. This fascinated a number of Gen-Yers and Millennials who took selfies.

Photo: United States Capitol, 2015, Matt C.

Honda Eyes Cooperation with General Motors on Driverless Cars

/0 Comments/in Future, Industry, News, TechnologyNikkei Asian Review

Research Study Releases Which Automakers Are Leading Autonomous Car Development Race (And It’s Not Tesla!)

/0 Comments/in Future, Industry, News, TechnologyIndustry Week

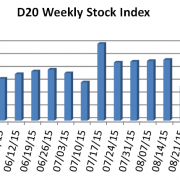

D20 Gainers Outnumber Losers for the Week with TomTom in the Lead

/0 Comments/in ArticleDriverless Transportation

Two consecutive weekly gains have pushed the Driverless Transportation (D20) Stock Index just over the 150 mark. The D20 Index outpaced both the Dow Jones Industrial Average and the S&P 500 by gaining 2.42 points or 1.63 percent to close the week at 150.83. The Dow lost 0.3 percent of its value while the S&P gave back 0.15 percent. In the D20, gainers outnumbered losers sixteen to four.

One of the D20’s newest members, TomTom (TOM2), led the advance this week with a 7.69 percent gain in value. TomTom’s rise was due to a combination of factors. First, since Nokia’s sale of its Here! mapping business, rumors continue to swirl around the prospect that TomTom will do the same. Second, TomTom announced strong year to date sales results. Right behind TomTom was BYD Company (BYDDY) who gained 6.98 percent.

The D20 loss leaders for the week were Volvo (VOLVY) who lost 4.30 percent of its value and Volkswagen (VLKPY) who lost 4.62 percent amid allegations that they cheated on their periodic state emissions testing for some of their diesel powered cars.

Since the D20 changed its measurement method on August 28th, 2015, the top three gainers have been:

- BYD Company (BYDDY) – up 10.78%

- TOMTOM (TOM2) – up 7.46%

- General Motors (GM) – up 5.41%

The three biggest losers have been:

- Mobileye (MBLY) – down 14.02%

- Renesas (TYO:6732) – down 7.49%

- Volkswagen (VLKPY) – down 4.83%

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

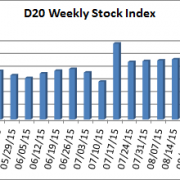

Growing Driverless Stock Index (D20) Reflects Dynamic Industry

/1 Comment/in Article, Impact, Industry, Technology Company, Vehicle CompanyWe have some exciting changes in the Driverless Transportation D20 Index to announce. First off, we are replacing three companies in the index and making the D20 more international in scope. We also changed the basis for our calculation of the D20 Index, moving to a dollar averaged approach.

The three new stocks in the D20 are:

- Amsterdam-based TomTom (TOM2) is traded on the Amsterdam Stock Exchange. It replaces Nokia (NOK) which is selling its Here mapping division, its only business involved in driverless or connected vehicles. TomTom, known for its popular aftermarket GPS turn-by-turn directional devices for cars, has three units that are involved with driverless technology – the auto unit provides components such as maps, traffic and software to auto OEMs; the licensing group leverages maps, traffic and navigation content and services; and the telematics unit is dedicated to fleet management and vehicle telematics.

- Ontario, Canada-based Magna International (MGA) is traded on the NYSE. It replaces the lightly-traded KVH Inc. (KVHI), a business that primarily delivers ISP services for hotels, resorts and ships. Magna has a large and growing electronics division which focuses on driver assistance systems, as well as systems to support power-train electrification. It manufactures electronic, electromechanical and mechatronic products, and provides software and hardware development.

- Tokyo-based Renesas Electronics (TYO: 6723) trades on the Tokyo Stock Exchange. It replaces Iteris (ITI), a lightly-traded firm that provides intelligent transportation systems for municipalities. Renesas was formed through a merger of NEC Electronics Corp., and Renesas Technology Corp., (a joint venture of Hitachi and Mitsubishi Electric). Renesas Electronics is a semiconductor manufacturer that designs, develops, manufactures, sells and services microcontrollers for the automotive industry.

The D20 Index now has companies — TomTom in Amsterdam and Renesas in Tokyo — with stocks that are primarily listed on non-US exchanges and use foreign currencies for prices. To calculate the D20 and include these stocks we convert the non-US stock prices (Euros and Japanese Yen) to US dollars using a current conversion ratio. The values were: Euro – currently 1.136 dollars per Euro; and Japanese Yen – currently .00829 dollars per Yen.

CALCULATING THE INDEX

We have changed the basis for calculating the D20 Index. Previously, the value of the D20 was calculated by using one share of stock from each of the 20 stocks in the index. With the new dollar-averaged approach we track the value of $1,000 invested in each of the 20 stocks. And on August 28, 2015 we started with roughly a total of $20,000 invested equally in the 20 stocks ($1,000 per company) in the D20 Index.

|

Name |

Symbol |

(As of 8/28/2015) | |||

| Share Price | Shares | Currency Conversion | Value | ||

| BlackBerry Ltd | BBRY | $ 7.37 | 135.690 | 1.000 | $ 1,000 |

| BYD COMPANY LTD ADR | BYDDY | $ 8.44 | 118.480 | 1.000 | $ 1,000 |

| Continental AG (ADR) | CTTAY | $ 42.86 | 23.330 | 1.000 | $ 1,000 |

| Daimler AG (USA) | DDAIF | $ 80.70 | 12.390 | 1.000 | $ 1,000 |

| Delphi Automotive PLC | DLPH | $ 75.35 | 13.270 | 1.000 | $ 1,000 |

| Denso Corp (ADR) | DNZOY | $ 22.69 | 44.070 | 1.000 | $ 1,000 |

| Ford Motor Company | F | $ 13.73 | 72.830 | 1.000 | $ 1,000 |

| General Motors Company | GM | $ 29.01 | 34.470 | 1.000 | $ 1,000 |

| Google Inc | GOOG | $ 630.38 | 1.586 | 1.000 | $ 1,000 |

| Magna | MGA | $ 49.23 | 20.313 | 1.000 | $ 1,000 |

| Mobileye NV Amsterdam | MBLY | $ 56.42 | 17.724 | 1.000 | $ 1,000 |

| Nissan Motor Co., Ltd. (ADR) | NSANY | $ 18.31 | 54.620 | 1.000 | $ 1,000 |

| NVIDIA Corporation | NVDA | $ 22.73 | 43.990 | 1.000 | $ 1,000 |

| Tesla Motors Inc | TSLA | $ 248.48 | 4.025 | 1.000 | $ 1,000 |

| TomTom | TOM2 | € 8.97 | 100.010 | 1.115 | $ 1,000 |

| Visteon Corp | VC | $ 100.49 | 9.950 | 1.000 | $ 1,000 |

| VALEO SA (ADR) | VLEEF | $ 63.66 | 15.710 | 1.000 | $ 1,000 |

| Volkswagen AG (ADR) | VLKPY | $ 38.32 | 26.100 | 1.000 | $ 1,000 |

| Volvo AB (ADR) | VOLVY | $ 10.94 | 91.410 | 1.000 | $ 1,000 |

| Renesas | TYO:6732 | ¥ 708.00 | 168.008 | 0.00841 | $ 1,000 |

Why the change? We found that with the one-share approach the stocks with the highest prices, i.e., Google, trading over $600, and Tesla, over $250, could swing the D20 wildly with just a small change in their pricing. The dollar-average approach means each company in the D20 now makes up about five percent of the index’s underlying value.

Why didn’t the D20 Index change radically when we switched the basis? We have always used a divisor with the D20 Index, and it started as 10.0. That meant we added up all the stock prices at the close of the trading day and divided by 10. To switch to the new dollar-average approach we changed the divisor so the new D2’s underlying value would be the same as the old D2. So on August 28, 2015 we used the closing stock prices to find the value of each of the two D20s, then adjusted the divisor for the dollar-averaged D20 so it had the same value as the old D20. The new divisor is 134.27296.

On September 4 we switched over to the revised D20 Index with the three new stocks and the new divisor.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.