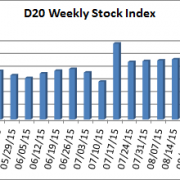

Growing Driverless Stock Index (D20) Reflects Dynamic Industry

Driverless Transportation

We have some exciting changes in the Driverless Transportation D20 Index to announce. First off, we are replacing three companies in the index and making the D20 more international in scope. We also changed the basis for our calculation of the D20 Index, moving to a dollar averaged approach.

The three new stocks in the D20 are:

- Amsterdam-based TomTom (TOM2) is traded on the Amsterdam Stock Exchange. It replaces Nokia (NOK) which is selling its Here mapping division, its only business involved in driverless or connected vehicles. TomTom, known for its popular aftermarket GPS turn-by-turn directional devices for cars, has three units that are involved with driverless technology – the auto unit provides components such as maps, traffic and software to auto OEMs; the licensing group leverages maps, traffic and navigation content and services; and the telematics unit is dedicated to fleet management and vehicle telematics.

- Ontario, Canada-based Magna International (MGA) is traded on the NYSE. It replaces the lightly-traded KVH Inc. (KVHI), a business that primarily delivers ISP services for hotels, resorts and ships. Magna has a large and growing electronics division which focuses on driver assistance systems, as well as systems to support power-train electrification. It manufactures electronic, electromechanical and mechatronic products, and provides software and hardware development.

- Tokyo-based Renesas Electronics (TYO: 6723) trades on the Tokyo Stock Exchange. It replaces Iteris (ITI), a lightly-traded firm that provides intelligent transportation systems for municipalities. Renesas was formed through a merger of NEC Electronics Corp., and Renesas Technology Corp., (a joint venture of Hitachi and Mitsubishi Electric). Renesas Electronics is a semiconductor manufacturer that designs, develops, manufactures, sells and services microcontrollers for the automotive industry.

The D20 Index now has companies — TomTom in Amsterdam and Renesas in Tokyo — with stocks that are primarily listed on non-US exchanges and use foreign currencies for prices. To calculate the D20 and include these stocks we convert the non-US stock prices (Euros and Japanese Yen) to US dollars using a current conversion ratio. The values were: Euro – currently 1.136 dollars per Euro; and Japanese Yen – currently .00829 dollars per Yen.

CALCULATING THE INDEX

We have changed the basis for calculating the D20 Index. Previously, the value of the D20 was calculated by using one share of stock from each of the 20 stocks in the index. With the new dollar-averaged approach we track the value of $1,000 invested in each of the 20 stocks. And on August 28, 2015 we started with roughly a total of $20,000 invested equally in the 20 stocks ($1,000 per company) in the D20 Index.

|

Name |

Symbol |

(As of 8/28/2015) | |||

| Share Price | Shares | Currency Conversion | Value | ||

| BlackBerry Ltd | BBRY | $ 7.37 | 135.690 | 1.000 | $ 1,000 |

| BYD COMPANY LTD ADR | BYDDY | $ 8.44 | 118.480 | 1.000 | $ 1,000 |

| Continental AG (ADR) | CTTAY | $ 42.86 | 23.330 | 1.000 | $ 1,000 |

| Daimler AG (USA) | DDAIF | $ 80.70 | 12.390 | 1.000 | $ 1,000 |

| Delphi Automotive PLC | DLPH | $ 75.35 | 13.270 | 1.000 | $ 1,000 |

| Denso Corp (ADR) | DNZOY | $ 22.69 | 44.070 | 1.000 | $ 1,000 |

| Ford Motor Company | F | $ 13.73 | 72.830 | 1.000 | $ 1,000 |

| General Motors Company | GM | $ 29.01 | 34.470 | 1.000 | $ 1,000 |

| Google Inc | GOOG | $ 630.38 | 1.586 | 1.000 | $ 1,000 |

| Magna | MGA | $ 49.23 | 20.313 | 1.000 | $ 1,000 |

| Mobileye NV Amsterdam | MBLY | $ 56.42 | 17.724 | 1.000 | $ 1,000 |

| Nissan Motor Co., Ltd. (ADR) | NSANY | $ 18.31 | 54.620 | 1.000 | $ 1,000 |

| NVIDIA Corporation | NVDA | $ 22.73 | 43.990 | 1.000 | $ 1,000 |

| Tesla Motors Inc | TSLA | $ 248.48 | 4.025 | 1.000 | $ 1,000 |

| TomTom | TOM2 | € 8.97 | 100.010 | 1.115 | $ 1,000 |

| Visteon Corp | VC | $ 100.49 | 9.950 | 1.000 | $ 1,000 |

| VALEO SA (ADR) | VLEEF | $ 63.66 | 15.710 | 1.000 | $ 1,000 |

| Volkswagen AG (ADR) | VLKPY | $ 38.32 | 26.100 | 1.000 | $ 1,000 |

| Volvo AB (ADR) | VOLVY | $ 10.94 | 91.410 | 1.000 | $ 1,000 |

| Renesas | TYO:6732 | ¥ 708.00 | 168.008 | 0.00841 | $ 1,000 |

Why the change? We found that with the one-share approach the stocks with the highest prices, i.e., Google, trading over $600, and Tesla, over $250, could swing the D20 wildly with just a small change in their pricing. The dollar-average approach means each company in the D20 now makes up about five percent of the index’s underlying value.

Why didn’t the D20 Index change radically when we switched the basis? We have always used a divisor with the D20 Index, and it started as 10.0. That meant we added up all the stock prices at the close of the trading day and divided by 10. To switch to the new dollar-average approach we changed the divisor so the new D2’s underlying value would be the same as the old D2. So on August 28, 2015 we used the closing stock prices to find the value of each of the two D20s, then adjusted the divisor for the dollar-averaged D20 so it had the same value as the old D20. The new divisor is 134.27296.

On September 4 we switched over to the revised D20 Index with the three new stocks and the new divisor.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.