Posts

Blackberry’s Big Bump Leads D20 Index Upwards

/0 Comments/in ArticleDriverless Transportation

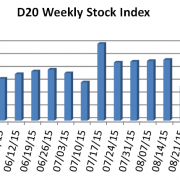

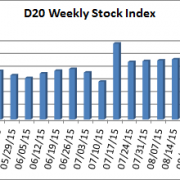

Buoyed by Blackberry (BBRY), the Driverless Transportation (D20) Stock Index rose 4.8 percent to end last week at 154.14. Gainers outnumbered losers 17 to three as the D20 Index outpaced both the Dow Jones Industrials and the S&P 500 Index. The Dow added 3.7 percent to finish the week at 17084.49 while the S&P 500 climbed 3.3 percent to close at 2014.89.

Under questions about its ability to deliver the planned sales volume of its highly acclaimed new Model X, Tesla’s stock price (TSLA) fell 10.9 percent to close the week at $220.69 and be this week’s largest D20 loser. The Model X has won rave reviews for its styling and technological features but skeptics continue to doubt Tesla’s ability to continue to scale its production capabilities to support its lofty valuation.

Blackberry was the D20 largest gainer for the week, adding 17 percent to its share price and closing the week at $7.42. CEO John Chen, has shifted the company away from phone handsets towards software, including its QNX division which creates the market leading operating system for cars infotainment systems. The combination of QNX’s current large car infotainment system market share and its background in self-driving military grade technology positions Blackberry perfectly to take advantage of growing interest by automakers in advanced self-driving systems.

Other double-digit gainers for the D20 last week were Volkswagen (VLKPY) whose stock price rebounded 15.2 percent, Daimler (DDIAF) whose price climbed 11.9 percent, and Volvo (VOLVY) whose price rose 10.5 percent.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks

ITS World 2015 Challenges US Lead in Driverless Vehicles

/0 Comments/in Article, Future, Government, Industry, Technology, Technology Company, Transportation, Vehicle CompanyBurney Simpson

There have been stories recently about Silicon Valley vs. Detroit battling for autonomous vehicle development dominance.

Guys, while you’re busy fighting, the rest of the world just may pass you.

The ITS World Congress held in Bordeaux, France, this week generated a slew of news about the driverless programs going on in Asia and Europe. One grabber was the fully-driverless 360-mile trip (580 kilometers) from Paris to Bordeaux in a Peugeot Citroen.

Volvo announced it would begin on-road testing in 2107 of its IntelliSafe Auto Pilot system. Drivers will use a push-button system on their XC90 steering wheel to switch to automated driving mode when they are traveling on sections of Swedish roads designated for driverless operations. Tests will be conducted on 30 miles of roads around Volvo’s headquarter city of Gothenburg.

Meanwhile, Volvo CEO Hakan Samuelsson traveled to Washington, D.C. to warn the feds they need to set national rules around the testing and development of driverless vehicles.

“The U.S. risks losing its leading position (in autonomous driving) due to the lack of federal guidelines for the testing and certification of autonomous vehicles,” Samuelsson said in a press release. “Europe has suffered to some extent by having a patchwork of rules and regulations. It would be a shame if the U.S. took a similar path to Europe in this crucial area.”

(Thanks for the thought, Mr. Samuelsson. Capitol Hill will get to it. First they have to pass extension 3,000 of the Highway Trust Fund. Then they need to investigate whether the next Speaker of the House is having an affair. We’re busy over here.)

Several thousand miles east of Gothenburg a Chinese transportation official said his country would invest $30 billion in its intelligent transportation system through 2020. A spending pledge from a bureaucrat may be wishful thinking but it indicates China is alert to the international attention shown to driverless technology. Besides this is the country with a driverless bus going 20 miles through a cityscape.

And then there are the Japanese. This week Toyota announced that it would offer in Japan this year three models equipped with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication capability. Toyota also pledged to bring cars to market by 2020 that the driver could put in autonomous auto-pilot mode so the vehicle could independently change lanes, merge with traffic, and pass other cars.

Also in the Land of the Rising Sun, the coastal city of Fujisawa will next year see a driverless taxi test provided by Robot Taxi (site is in Japanese). Plans call for the cabs to take about 50 participating residents on local shopping excursions of about 3 kilometers, The Guardian reports. The test is in preparation for the 2020 Olympics which will be hosted just down the road in Tokyo.

Granted, similar products and concepts are going on in the U.S. And granted, some of this is savvy marketers who are just as smart as Americans when it comes to grabbing headlines.

For that matter, the competition between Detroit and California is driving tech advances and helping to make the U.S. the place to be when it comes to driverless research and development.

But fighting in your own backyard only gets you so far. Let’s hope we don’t see a repeat of the 1960s-1970s when Japan ate Detroit’s lunch.

Volvo: We’ll Accept Liability in Self-Driving Car Accidents

/0 Comments/in Future, Industry, Insurance, Legal, NewsRobotics Trends

D20 Gainers Outnumber Losers for the Week with TomTom in the Lead

/0 Comments/in ArticleDriverless Transportation

Two consecutive weekly gains have pushed the Driverless Transportation (D20) Stock Index just over the 150 mark. The D20 Index outpaced both the Dow Jones Industrial Average and the S&P 500 by gaining 2.42 points or 1.63 percent to close the week at 150.83. The Dow lost 0.3 percent of its value while the S&P gave back 0.15 percent. In the D20, gainers outnumbered losers sixteen to four.

One of the D20’s newest members, TomTom (TOM2), led the advance this week with a 7.69 percent gain in value. TomTom’s rise was due to a combination of factors. First, since Nokia’s sale of its Here! mapping business, rumors continue to swirl around the prospect that TomTom will do the same. Second, TomTom announced strong year to date sales results. Right behind TomTom was BYD Company (BYDDY) who gained 6.98 percent.

The D20 loss leaders for the week were Volvo (VOLVY) who lost 4.30 percent of its value and Volkswagen (VLKPY) who lost 4.62 percent amid allegations that they cheated on their periodic state emissions testing for some of their diesel powered cars.

Since the D20 changed its measurement method on August 28th, 2015, the top three gainers have been:

- BYD Company (BYDDY) – up 10.78%

- TOMTOM (TOM2) – up 7.46%

- General Motors (GM) – up 5.41%

The three biggest losers have been:

- Mobileye (MBLY) – down 14.02%

- Renesas (TYO:6732) – down 7.49%

- Volkswagen (VLKPY) – down 4.83%

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

Growing Driverless Stock Index (D20) Reflects Dynamic Industry

/1 Comment/in Article, Impact, Industry, Technology Company, Vehicle CompanyWe have some exciting changes in the Driverless Transportation D20 Index to announce. First off, we are replacing three companies in the index and making the D20 more international in scope. We also changed the basis for our calculation of the D20 Index, moving to a dollar averaged approach.

The three new stocks in the D20 are:

- Amsterdam-based TomTom (TOM2) is traded on the Amsterdam Stock Exchange. It replaces Nokia (NOK) which is selling its Here mapping division, its only business involved in driverless or connected vehicles. TomTom, known for its popular aftermarket GPS turn-by-turn directional devices for cars, has three units that are involved with driverless technology – the auto unit provides components such as maps, traffic and software to auto OEMs; the licensing group leverages maps, traffic and navigation content and services; and the telematics unit is dedicated to fleet management and vehicle telematics.

- Ontario, Canada-based Magna International (MGA) is traded on the NYSE. It replaces the lightly-traded KVH Inc. (KVHI), a business that primarily delivers ISP services for hotels, resorts and ships. Magna has a large and growing electronics division which focuses on driver assistance systems, as well as systems to support power-train electrification. It manufactures electronic, electromechanical and mechatronic products, and provides software and hardware development.

- Tokyo-based Renesas Electronics (TYO: 6723) trades on the Tokyo Stock Exchange. It replaces Iteris (ITI), a lightly-traded firm that provides intelligent transportation systems for municipalities. Renesas was formed through a merger of NEC Electronics Corp., and Renesas Technology Corp., (a joint venture of Hitachi and Mitsubishi Electric). Renesas Electronics is a semiconductor manufacturer that designs, develops, manufactures, sells and services microcontrollers for the automotive industry.

The D20 Index now has companies — TomTom in Amsterdam and Renesas in Tokyo — with stocks that are primarily listed on non-US exchanges and use foreign currencies for prices. To calculate the D20 and include these stocks we convert the non-US stock prices (Euros and Japanese Yen) to US dollars using a current conversion ratio. The values were: Euro – currently 1.136 dollars per Euro; and Japanese Yen – currently .00829 dollars per Yen.

CALCULATING THE INDEX

We have changed the basis for calculating the D20 Index. Previously, the value of the D20 was calculated by using one share of stock from each of the 20 stocks in the index. With the new dollar-averaged approach we track the value of $1,000 invested in each of the 20 stocks. And on August 28, 2015 we started with roughly a total of $20,000 invested equally in the 20 stocks ($1,000 per company) in the D20 Index.

|

Name |

Symbol |

(As of 8/28/2015) | |||

| Share Price | Shares | Currency Conversion | Value | ||

| BlackBerry Ltd | BBRY | $ 7.37 | 135.690 | 1.000 | $ 1,000 |

| BYD COMPANY LTD ADR | BYDDY | $ 8.44 | 118.480 | 1.000 | $ 1,000 |

| Continental AG (ADR) | CTTAY | $ 42.86 | 23.330 | 1.000 | $ 1,000 |

| Daimler AG (USA) | DDAIF | $ 80.70 | 12.390 | 1.000 | $ 1,000 |

| Delphi Automotive PLC | DLPH | $ 75.35 | 13.270 | 1.000 | $ 1,000 |

| Denso Corp (ADR) | DNZOY | $ 22.69 | 44.070 | 1.000 | $ 1,000 |

| Ford Motor Company | F | $ 13.73 | 72.830 | 1.000 | $ 1,000 |

| General Motors Company | GM | $ 29.01 | 34.470 | 1.000 | $ 1,000 |

| Google Inc | GOOG | $ 630.38 | 1.586 | 1.000 | $ 1,000 |

| Magna | MGA | $ 49.23 | 20.313 | 1.000 | $ 1,000 |

| Mobileye NV Amsterdam | MBLY | $ 56.42 | 17.724 | 1.000 | $ 1,000 |

| Nissan Motor Co., Ltd. (ADR) | NSANY | $ 18.31 | 54.620 | 1.000 | $ 1,000 |

| NVIDIA Corporation | NVDA | $ 22.73 | 43.990 | 1.000 | $ 1,000 |

| Tesla Motors Inc | TSLA | $ 248.48 | 4.025 | 1.000 | $ 1,000 |

| TomTom | TOM2 | € 8.97 | 100.010 | 1.115 | $ 1,000 |

| Visteon Corp | VC | $ 100.49 | 9.950 | 1.000 | $ 1,000 |

| VALEO SA (ADR) | VLEEF | $ 63.66 | 15.710 | 1.000 | $ 1,000 |

| Volkswagen AG (ADR) | VLKPY | $ 38.32 | 26.100 | 1.000 | $ 1,000 |

| Volvo AB (ADR) | VOLVY | $ 10.94 | 91.410 | 1.000 | $ 1,000 |

| Renesas | TYO:6732 | ¥ 708.00 | 168.008 | 0.00841 | $ 1,000 |

Why the change? We found that with the one-share approach the stocks with the highest prices, i.e., Google, trading over $600, and Tesla, over $250, could swing the D20 wildly with just a small change in their pricing. The dollar-average approach means each company in the D20 now makes up about five percent of the index’s underlying value.

Why didn’t the D20 Index change radically when we switched the basis? We have always used a divisor with the D20 Index, and it started as 10.0. That meant we added up all the stock prices at the close of the trading day and divided by 10. To switch to the new dollar-average approach we changed the divisor so the new D2’s underlying value would be the same as the old D2. So on August 28, 2015 we used the closing stock prices to find the value of each of the two D20s, then adjusted the divisor for the dollar-averaged D20 so it had the same value as the old D20. The new divisor is 134.27296.

On September 4 we switched over to the revised D20 Index with the three new stocks and the new divisor.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.

Volvo: Roads will be Safer if 5.9 GHZ Band Reserved for Driverless Tech

/1 Comment/in Article, Future, Government, Industry, Legal, Vehicle CompanyBurney Simpson

An important driverless technology advocate ramped up the battle for wireless bandwidth, urging the U.S. Senate keep the Dedicated Short-Range Communications (DSRC) 5.9 GHz spectrum reserved for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications.

Ensuring that portion of spectrum exclusively to such autonomous and self-driving technologies will lead to safer roads and more efficient delivery of freight, Susan Alt, Volvo Group North America’s senior vice president of public affairs, told a Senate subcommittee on July 7.

OPENING 5.9 GHZ

Alt spoke before the Surface Transportation and Merchant Marine Infrastructure, Safety and Security subcommittee during a hearing titled “Technologies Transforming Transportation: Is the Government Keeping Up?“ (Visit here for a transcript of Alt’s testimony).

Volvo’s position as stated by Alt put it in opposition to Sen. Corey Booker, a New Jersey Democrat and the ranking member of the subcommittee, and Sen. Marco Rubio, a Florida Republican running for president.

The two joined in February to sponsor the Wi-Fi Innovation Act (S 242) that would require the Federal Communication Commission to test opening the 5.9 GHz band to greater public use beyond certain automated vehicle technologies.

In her testimony Alt noted there are now four types of automated technology available to heavy-duty truck users including adaptive cruise controls and rear view cameras; remote monitoring equipment of driver behavior; remote monitoring equipment that predicts vehicle problems; and technology that checks the driver’s route to avoid possible delays.

Taking autonomous driving technology to the next step means improving V2V and V2I communications, and keeping other Wi-Fi communications out of the 5.9 GHz band.

“The concern is that by allowing other technologies to be shared on the same spectrum, it could create a lag or latency in sending critical and lifesaving communication signals. Therefore, we … (oppose) the Wi-Fi Innovation Act that would open up the 5.9 GHz frequency spectrum to Wi-Fi access for non-safety and other applications such as entertainment and advertising,” Alt testified.

Leaders from the National Highway Traffic Safety Administration and the University of Michigan’s Transportation Research Institute (UMTRI) have also opposed opening the 5.9 frequency spectrum to non-safety applications.

ELIMINATING HUMAN ERRORS

As part of her testimony Alt offered two Volvo Truck videos. One from October 2014 previews heavy-duty trucks the video says will be “market ready in five to 10 years” and capable of providing a 360-degree scan from the driver’s seat that will virtually eliminate human errors.

The video claims the technology will be able to see all the objects within this 360 scan, including vehicles, bikes and pedestrians, and predict up to five seconds ahead of time what these moving objects might do. It will send a warning to the driver of possible accident-causing actions, and take control of the truck to avoid the accident if the driver doesn’t.

A second video released this month offers Volvo Vision 2020. It uses animation to show heavy- duty trucks platooning on the highway, allowing drivers in the following trucks to switch to a ‘driverless’ mode.

Alt also took the opportunity to champion two other major issues facing the freight trucking industry.

First, there is a need for federal definitions and rules on autonomous technology for freight trucks that supersede state regulations. Today, some states are setting their own rules, creating a patchwork of regulations, and that is slowing the development of the technology, she said.

Second, Volvo Trucks would like to eliminate the 12 percent Federal Excise Tax on the sale of a new heavy-duty truck. Adding new autonomous technologies will make trucks more expensive and the tax more onerous. Instead, replace the excise tax with a higher fuel tax, which will have the added benefit of encouraging the adoption of the new technologies, said Alt.

Volvo Trucks markets heavy-duty trucks, engines, and transmissions under the Volvo and Mack brand names, along with marine engines, coaches, and transit buses, said Alt. The U.S. is its largest market.

Feature photo courtesy America’s Road Team program sponsored by Volvo Trucks.