VW’s Dead Cat Bounce Lifts D20 Index

Driverless Transportation

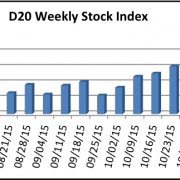

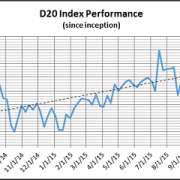

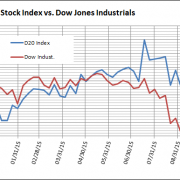

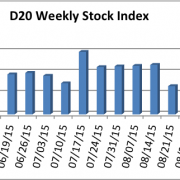

With 13 gainers, six losers, and NVIDIA (NVDA) unchanged, the Driverless Transportation Stock Index (D20) gained 0.6 percent last week to close at 162.24. In a relatively quiet week for the indexes, the D20 edged out the Dow Jones Industrials decline of 0.1 percent and the virtually unchanged S&P 500.

Leading the D20 Index this week, Volkswagen (VLKPY), in a typical ‘dead cat bounce’, gained a whopping 17.2 percent to end at $26.36. There was little news other than Volkswagen’s refusal to compensate European vehicle owners for the rigged emissions tests, so the only explanation for the price jump is that short investors bought stock to cover their bets. Volkswagen has lost 31 percent of its value since early September.

The biggest loser for the D20 this week was the Chinese electric car and battery maker BYD (BYDDY), shedding 13 percent of its value and closing at $10.56. BYD’s share price continues its rollercoaster ride, plummeting to a low of $7.70 and rising to a high of $12.53 in the last 12 weeks, a range of almost 63 percent.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.