Driverless Transportation

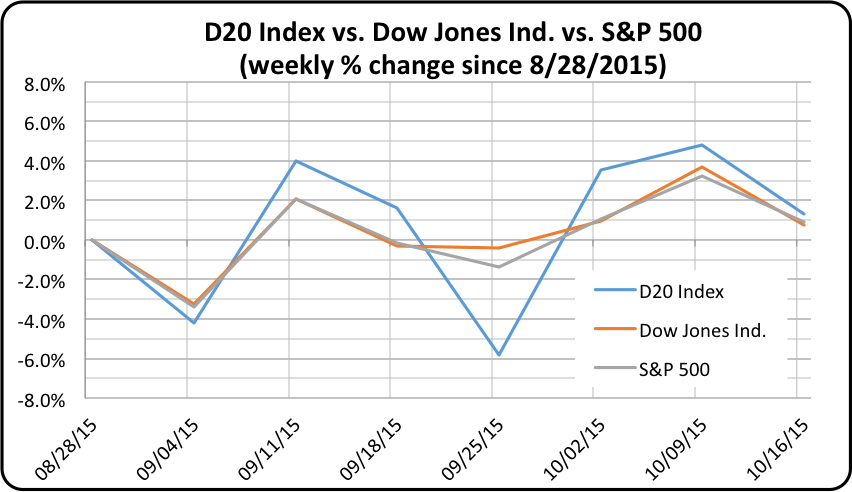

It has been a little more than a year since we started tracking stocks for the Driverless Transportation (D20) Stock Index. On August 1, 2014, the D20 Index started at 139.694, and since then it has gained 13.322 to finish on July 31, 2015, at 153.016, a one-year rise of 9.5 percent. That gain compares favorably to the Dow Jones Industrial Average and the S&P 500 Index over that same period.

![D20 Index Dow Jones Index S&P Index for year 2014-2015]()

The performance of the D20 Index component stocks displayed considerable diversity over that first year, as shown by the following table. Highlighted in green and red are each of the four stocks that finished as the top gainer and loser in stock value and by percent.

![D20 Compositions prices for 2014-2015]()

By increasing its share price by $59.54 in the first year of the D20, Google (GOOG) was the index’s absolute price gainer by far. At over 40 percent ![Google 2014-2015]() of the D20 Index, when Google sneezes the D20 gets pneumonia. That paid off for the index this July when Google had a stupendous month, rising from $521.84 on July 1 to $625.61 on the 31st, a gain of more than $100. Interestingly, without that great July, Google would have been our absolute price loser for the year.

of the D20 Index, when Google sneezes the D20 gets pneumonia. That paid off for the index this July when Google had a stupendous month, rising from $521.84 on July 1 to $625.61 on the 31st, a gain of more than $100. Interestingly, without that great July, Google would have been our absolute price loser for the year.

Another shining star for the D20 Index in its inaugural year was Mobileye (MBLY), which led all D20 stocks in price percentage gained. Mobileye’s IPO was only a few days before the August 1, 2014, start date of the index, and the Israel-based stock had a meteoric rise out of the gate. Reality set in from October 2014 to March 2105 when Mobilieye returned very close to its IPO price. Since March 2015 it has recorded steady monthly increases.![Mobileye 2014-2015]() In the D20’s first year Mobileye increased its share price a whopping 62.4 percent, rising from $37.00 to $60.10. As the only company in the D20 Index whose primary source of revenue is generated by “connected” or “driverless” products, this outstanding performance bodes well for the financial future of the driverless market.

In the D20’s first year Mobileye increased its share price a whopping 62.4 percent, rising from $37.00 to $60.10. As the only company in the D20 Index whose primary source of revenue is generated by “connected” or “driverless” products, this outstanding performance bodes well for the financial future of the driverless market.

Here’s another sign of just how well the D20 Index did in its inaugural year — the stock that saw the largest price loss dropped a mere $6.25 in value. Headquartered in Wolfsburg, Germany, Volkswagen (VLKPY) earned this dubious honor by riding its rollercoaster share price from $46.27 on August 1, 2014 to a close of $40.02 on July 31, 2015. During that period it closed as high as $54.02 and as low as $37.95. If sales volume is any indicator, Volkswagen may be on the rebound. It announced recently that it had passed Toyota as the largest passenger car ma![Volkswagen 2014-2015]() ker in the world by shipping more cars than anyone in the second quarter this year. And its Audi division is one of the leading auto OEMs in investing in driverless technologies.

ker in the world by shipping more cars than anyone in the second quarter this year. And its Audi division is one of the leading auto OEMs in investing in driverless technologies.

The Chinese electric vehicle manufacturer BYD Company (BYDDY) has the distinction of being the D20 component stock whose share price lost the greatest percentage during the index’s first year. On August 1, 2014, BYD’s ADRs closed at $12.84. Its closing price on July 31 this year was $8.78, for a 31.6 percent loss in value. ![BYD 2014-2015]() In those 12 months BYD traded as high as $14.98 and as low as $6.48. Even a significant investment from Warren Buffett’s Berkshire Hathaway couldn’t keep BYD from losing almost a third of its value. Certainly some of that loss was due to the recent devaluation of the Chinese Yuan and the roiling financial effect that had on Chinese companies.

In those 12 months BYD traded as high as $14.98 and as low as $6.48. Even a significant investment from Warren Buffett’s Berkshire Hathaway couldn’t keep BYD from losing almost a third of its value. Certainly some of that loss was due to the recent devaluation of the Chinese Yuan and the roiling financial effect that had on Chinese companies.

There will be some changes coming to the D20 Index in the next few weeks. Nokia’s sale of its HERE mapping business means it doesn’t have a presence in the driverless space, and it needs to be replaced in the D20. Better international representation would improve the D20 Index’s reflection of the global nature of driverless technology’s reach. And Google and Tesla (TSLA) together make up over 55 percent of the D20 Index value because of their high stock prices. Although both are leaders in the driverless space, a smaller representation would be more reflective of the financial health of the industry.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.