Tesla, China Woes Drag D20 Down

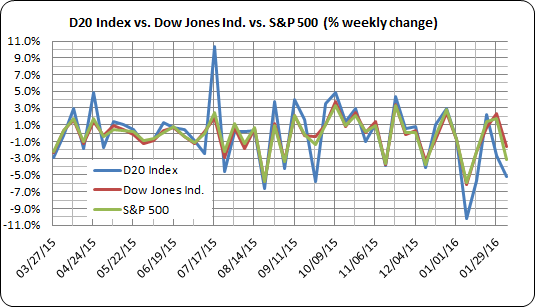

The Driverless Transportation (D20) Stock Index last week dropped 5.1 percent to 129.30, its lowest point since its inception in August 2014. Both the Dow and S&P also declined but not as dramatically as the D20. The Dow lost 1.6 percent to close at 16204.97 while the S&P fell 3.1 percent to finish at 1880.05. The week’s plunge for the D20 was broad, with 18 losers, one gainer and one unchanged.

The D20 has lost 22.3 percent of its value just since Christmas. In that same period the Dow declined 7.7 percent and the S&P dropped 8.9 percent as investors sold stocks while nervously watching China’s slowing growth.

The lone bright spot for the D20 this week was BYD Company (BYDDY), the Chinese electric vehicle and battery manufacturer. BYD’s ADR eked out a 1.1 percent gain by adding $0.10 to finish at $9.14. In contrast, America’s preeminent electric car manufacturer, Tesla (TSLA), was the largest D20 loser, plummeting from $191.20 to $162.60, a 15 percent decline. The continued drop in gasoline prices in the US has investors worried that demand for Tesla’s electric cars will wane.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.