NVIDIA Goes All In on Driverless Technology

Stephen Feyer

NVIDIA is synonymous with high-performance graphics chips. Can it dominate the chip market for autos too?

Founded in 1993, NVIDIA Corp. (NVDA) is a leader in chipsets for visual processing. Its chipsets are used in video game consoles, computer-aided design, digital image processing, and in research applications. The company also manufactures a system-on-a-chip for mobile devices and auto manufacturers.

NVIDIA has targeted the automotive sector as an area of future growth. Today, NVIDIA sells its DRIVE platform, based on its Tegra system-on-a-chip technology, to OEMs and suppliers. Tegra is used to operate in-vehicle entertainment units, advanced driver assistance systems, and instrumentation. The company lists 19 automotive partners on its website including Honda, BMW, Volkswagen, Porsche, and Tesla.

In January 2015, at the International Consumer Electronics Show in Las Vegas, NVIDIA founder and CEO Jen-Hsun Huang announced the Drive PX platform, a new system designed to operate an autonomous vehicle. The system uses two Tegra X1 chips that can process high-definition images from up to a dozen cameras at once, allowing it to serve as the “brain” of an autonomous vehicle using visual sensing instruments. Built-in algorithms include “deep learning” object recognition.

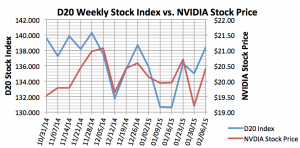

Over the last two years, NVIDIA’s NASDAQ-listed stock has steadily risen, moving from $12 at the end of 2012 to around $20 at the beginning of February 2015. NVIDIA’s market cap stands at over $10 billion.

Public since January 1999, NVIDIA first began paying a dividend in the first quarter of 2013, offering an annual yield of about 2 percent since it initiated the payout.

In fiscal 2014, NVIDIA reported income of $0.75 a share on revenue of $4.13 billion. Both numbers were down from 2013, when the company reported $0.91 EPS on revenue of $4.28 billion. Fiscal 2014 represented a second consecutive year of declining EPS.

The revenue loss is due to a 48 percent drop in the Tegra system-on-a-chip business, falling from $764 million in 2013 to $398 million in 2014. Much of the decline can be attributed to a delay in the launch of the Tegra 4 line of processors while the Tegra 3 line was phased out.

However, sales have also declined because Tegra is a high-end system competing against rivals Intel and AMD in the price-conscious mobile-chipset market. In response to these challenges, NVIDIA has turned to the automotive sector where its advanced processors and specialized software work well in driverless transportation systems.

In 2014 NVIDIA went all in on research and development, committing nearly three-quarters of the company’s 8,800 employees to the effort, and increasing spending to $1.4 billion, up 20 percent from just two years ago.

With a desire to reinvigorate its Tegra line in the auto industry, and a greater push in R&D, NVIDIA is positioning itself as the key technology behind the next generation of computerized cars, including driverless cars. NVIDIA maintains a sense of humor despite its challenges: its development kit for automotive applications such as infotainment, instrumentation, and ADAS is called “Jetson”.

NVIDIA is categorized in the technology group of the D20 Stock Index, which also includes Blackberry Ltd, (BBRY), Iteris, (ITI), KVH Industries (KVHI), Nokia Corp. (NOK), and Mobileye (MBLY).

Stephen Feyer is a James R. Swartz Entrepreneurial Fellow and MBA at Carnegie Mellon University’s Tepper School of Business.

This article is part of the Driverless Transportation series profiling the stocks that make up the Driverless Transportation D20 Stock Index, the only index that tracks the major publicly-traded firms in the autonomous driving industry worldwide.