What’s New – February 9, 2015

Driverless Transportation

IN THIS WEEK’S ISSUE:

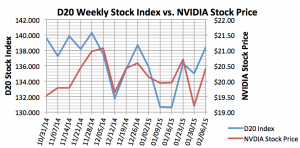

A profile of NVIDIA, the chip provider striving to makes its Tegra processor a core part of autonomous vehicle technology. And scroll down for a snapshot of NVDA’s trading last week compared with the D20 Driverless Transportation Stock Index. We also offer a brief on Europe’s promising MobilCity2 public transit project that is testing several vehicles in cities of various sizes.

NEW EVENTS & REPORTS:

- In our events section, the International Conference on Transport & Health, a first of its kind gathering, is scheduled for July 6-8 in London;

- A Report by the Boston Consulting Group finds that Self Driving Features May be Worth $42 Billion by 2025.

IN THE NEWS:

- A Fortune article on autonomous vehicles and weather conditions;

- Audi Chairman Hackenberg tells Automotive News that state laws are slowing the launch of autonomous vehicles;

- Is Google developing its own version of Uber?;

- Phys.org talks about researchers improving AI algorithms for semi-autonomous vehicles.

The Driverless Transportation D20 Stock Index grew a healthy 3.35 points or nearly 2.5 percent to end the week at 138.377. The Index was driven largely by a price jump in auto parts manufacturer Delphi Automotive (DLPH) after it said it expects sales of its software-powered advanced vehicle-safety systems would increase 50 percent annually for the next several years. These safety systems are a part of the steps in technology required so automobile OEMs can offer driverless vehicles. Delphi also reported solid fourth quarter numbers, sending the stock up $8.43, or 12.3 percent, to end the week at $77.16.

D20 gainers outnumbered losers 15 to five. Two standouts — General Motors (GM), up 10.4 percent to $36.00, and Tesla Motors (TSLA), up nearly 7 percent to $217.36. Mobileye (MBLY) was the largest percentage loser with a drop of about 7.3 percent to finish the week at $36.53.

This week’s featured D20 Stock Index component, NVIDIA (NVDA), added $1.20, or 6.3 percent, to end the week at $20.40. NVIDIA’s stock has traded in a narrow 4 percent range between $19.13 and $21.14 for the last three months.

Visit the D20 Stock Index page for more.