A Wow Week as All D20 Stocks Rise

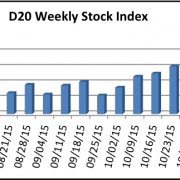

Wow. All 20 of the Driverless Transportation (D20) Stock Index component stocks were winners last week, sending the index up more than 3 percent to close Friday at 149.58. Now that’s a nice start to a three-day weekend.

The best percentage performer for the week was Blackberry (BBRY), gaining nearly 6.2 percent and closing Friday at 7.23. No substantive news but BBRY received huge press as Hillary Clinton’s favorite email device while Secretary of State. She used it for personal and official business, a wow of a no-no.

The big story, again, was Nvidia (NVDA). The stock of the graphic processing unit (GPU) chipmaker has more than doubled in value since last summer when the D20 was updated. NVDA closed last week at 45.90, up from 22.73 on August 28, 2015. Time to sell?

Another interesting story was Volkswagen (VLKPY). The auto OEM is reportedly close to finalizing a settlement of its diesel emissions scandal in the US, and it announced a $300 million investment in Tel Aviv based Gett, a ride-sharing app looking to expand in Europe.

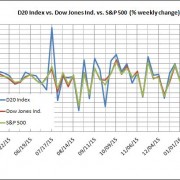

Last week’s D20 performance topped the 2 percent rise in the Dow Industrials and 2.3 percent increase in the S&P 500 Index.

Visit the Driverless Transportation D20 Stock Index page to learn more about it and its component stocks.